Client's Need

Michael, a busy professional, struggles to manage his finances efficiently. He faces challenges in budgeting, tracking expenses, and making informed financial decisions on the go. Michael is searching for a mobile application that can provide a comprehensive solution for personal finance management, offering features that simplify budgeting, enhance financial visibility, and provide actionable insights to improve his financial health.

Solution

Introducing "FinEase" - a robust mobile application designed to empower users like Michael in managing their personal finances seamlessly. FinEase offers a suite of features that cater to various aspects of financial management, ensuring users have a clear understanding of their financial status and enabling them to make informed decisions.

Key Features:

Expense Tracking:

- Real-Time Expense Logging: Easily log and categorize expenses in real time.

- Receipt Scanner: Utilize OCR technology to scan and store receipts for easy expense tracking.

Budget Management:

- Customizable Budgets: Set personalized budgets for different expense categories.

- Budget Tracking: Monitor spending against budget limits, with real-time updates and notifications.

Financial Insights:

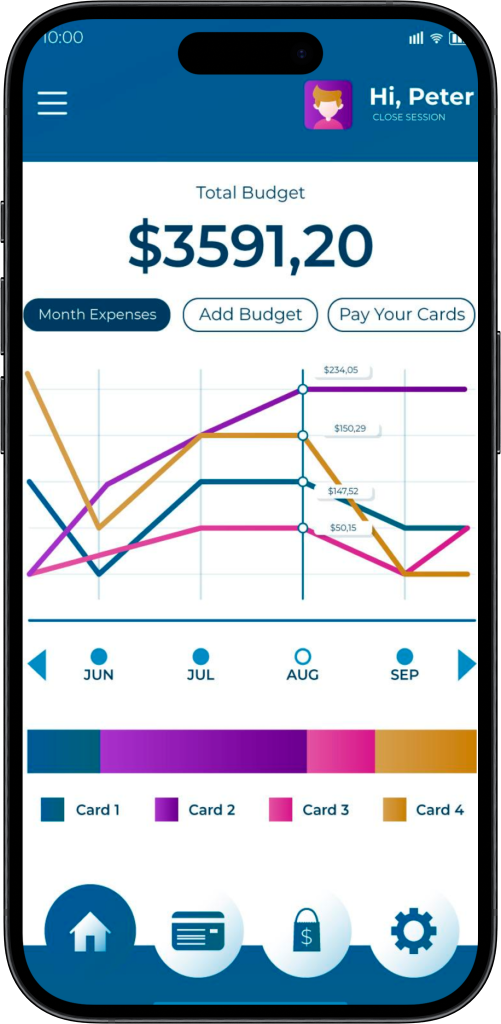

- Visual Analytics: Provide intuitive graphs and charts to visualize income, expenses, and savings over time.

- Income vs. Expenses Report: Analyze the balance between income and expenses to identify areas for improvement.

Financial Goal Setting:

- Goal Tracker: Set financial goals and track progress over time.

- Savings Plans: Suggest and automate savings plans based on user-defined goals.

Security and Alerts:

- Bank-Level Security: Implement robust security measures to ensure the safety of financial data.

- Transaction Alerts: Receive real-time alerts for large transactions, account balances, and unusual activity.

Client Benefits

- Improved Financial Visibility:FinEase provides a clear and real-time overview of income, expenses, and savings, enabling users like Michael to make informed financial decisions.

- Efficient Expense Management: The expense tracking and budget management features simplify the process of monitoring and controlling spending.

- Goal-Oriented Savings: Financial goal setting and automated savings plans help users work towards achieving their financial objectives.

- Enhanced Security: With bank-level security measures and real-time transaction alerts, FinEase ensures the safety and integrity of users' financial data.

FinEase serves as a comprehensive financial companion, empowering users to take control of their finances, achieve their financial goals, and make informed decisions for a secure financial future.